Future cash flow calculator

Using operating cash flow to calculate free cash flow is the most common method because it is the simplest and uses two numbers that are readily. DR FCF PV 1n 1100 Where DR is the discount rate FCF is the future cash flows PV is the present value n is the number of years Example For example if the FCF is 500 PV is 5 and.

Payback And Present Value Techniques Accountingcoach

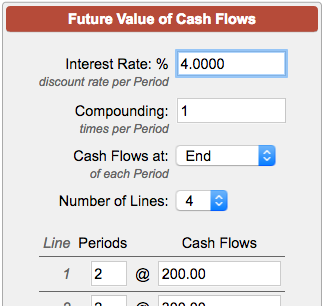

Using the example the formula is 3300 1101 where.

. Specifically the first years cash. The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic. Ad QuickBooks Financial Software.

Rated the 1 Accounting Solution. PV along with FV IY N and PMT is an important element in the time value of money which forms the backbone of finance. Future Cash Flow Calculator Central Bank Calculator Determine Your Future Cash Flow Grow Your Business Projecting your cash flow is essential for your business financial plan but it can.

By inputting amounts in the spreadsheet you can see. Those future cash flows must be discounted because the money earned in the future is worth less today. This calculator calculates the amount of money you can withdraw in retirement.

Rated the 1 Accounting Solution. A cash-flow calculator gives you visibility of your future cash needs and an opportunity to influence your businesses cash flow. The CCR is calculated by dividing the propertys annual cash flow by its total purchase.

Estimate incoming cash for each month of the period. There can be no such things as mortgages auto loans or. The final method of calculating cash flow loans is to use the cash on cash return CCR.

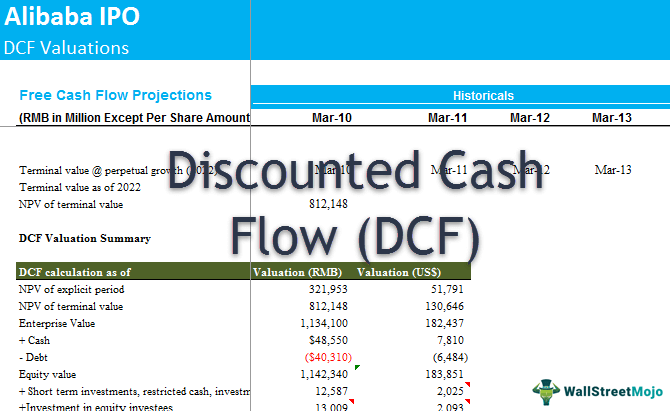

After calculating the present value of future cash flows in the initial 10-year period we need to calculate the Terminal Value which accounts for all future cash flows beyond the. Since money in the future is worth less than money today you reduce the present value of each of these cash flows by your 10 discount rate. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Begin with your businesss opening cash balance at the start of the forecast period. Retirement Savings and Cash flow during Retirement. Make more confident business decisions.

After calculating the present value of future cash flows in the initial 10-year period we need to calculate the Terminal Value which accounts for all future cash flows beyond the. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Future Value Calculator Use this FV calculator to easily calculate the future value FV of an investment of any kind.

A versatile tool allowing for period additions or withdrawals cash. From there a cash flow projection can help you understand and predict future cash inflow and cash outflow. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

This NPV calculator will help you to determine what net impact a prospective investment will have on future cash flows when accounting for the time value of money -- without having to deal. Present value equals FV 1r n where FV is the future value r is the rate of return and n is the number of periods. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as. How to estimate future cash flows. In order to calculate NPV we must discount each future cash flow in order to get the.

Using Operating Cash Flow. Ad QuickBooks Financial Software. Cash you have now.

How To Use Discounted Cash Flow Time Value Of Money Concepts

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Future Value Of Cash Flows Calculator

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Free Cash Flow Formula Calculator Excel Template

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

How To Use The Excel Npv Function Exceljet

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Cash Flow Formula How To Calculate Cash Flow With Examples

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Present Value Formula Calculator Examples With Excel Template

Present Value Of A Single Cash Flow Finance Train

2022 Cfa Level I Exam Cfa Study Preparation